Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

The Florida 13 Plan refers to a redistricting plan proposed for the congressional districts in the state of Florida. It was developed in response to a court order in 2015 regarding the invalidation of Florida's existing congressional map due to gerrymandering.

The Florida 13 Plan aimed to redraw the boundaries of the state's congressional districts in a manner that followed the guidelines set by the court. The plan was named after one of the districts, District 13, and it sought to rectify the previous issues of partisan gerrymandering by creating more compact and geographically cohesive districts.

The Florida 13 Plan was one of several proposals put forth during the redistricting process, and it received some support from voting rights advocates who believed that it would result in fairer representation for the state's residents. However, it is important to note that the plan may have undergone modifications or changes since it was initially proposed.

Who is required to file florida 13 plan?

The person who is required to file a Florida 13 plan is someone who has filed for Chapter 13 bankruptcy in the state of Florida.

How to fill out florida 13 plan?

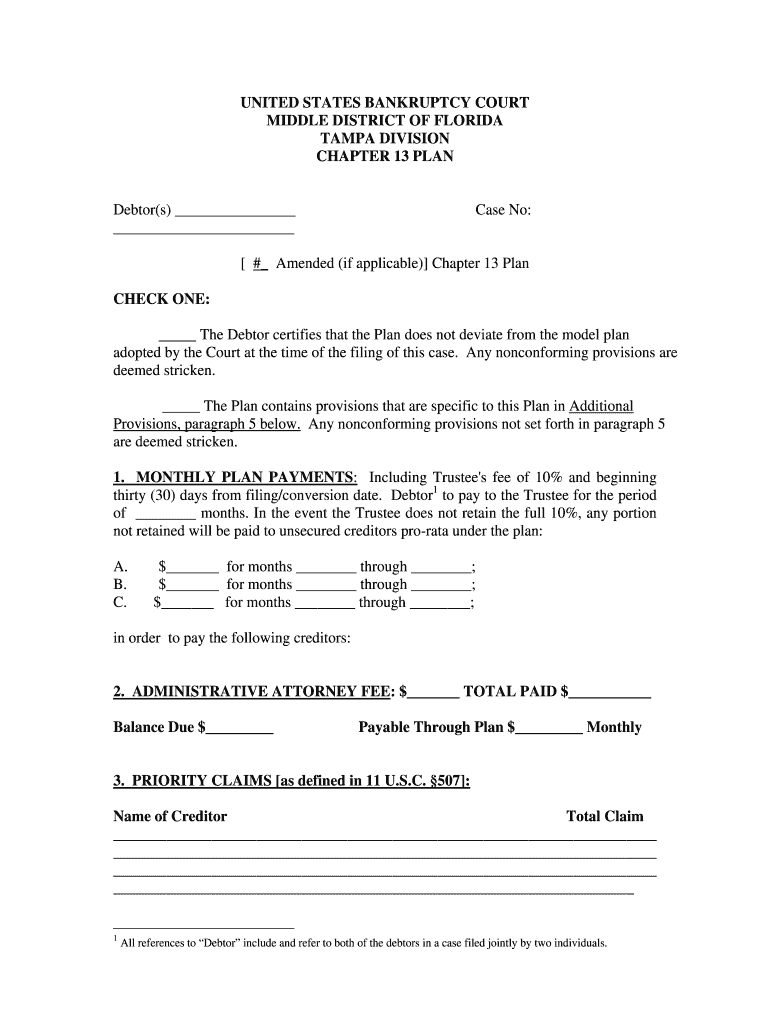

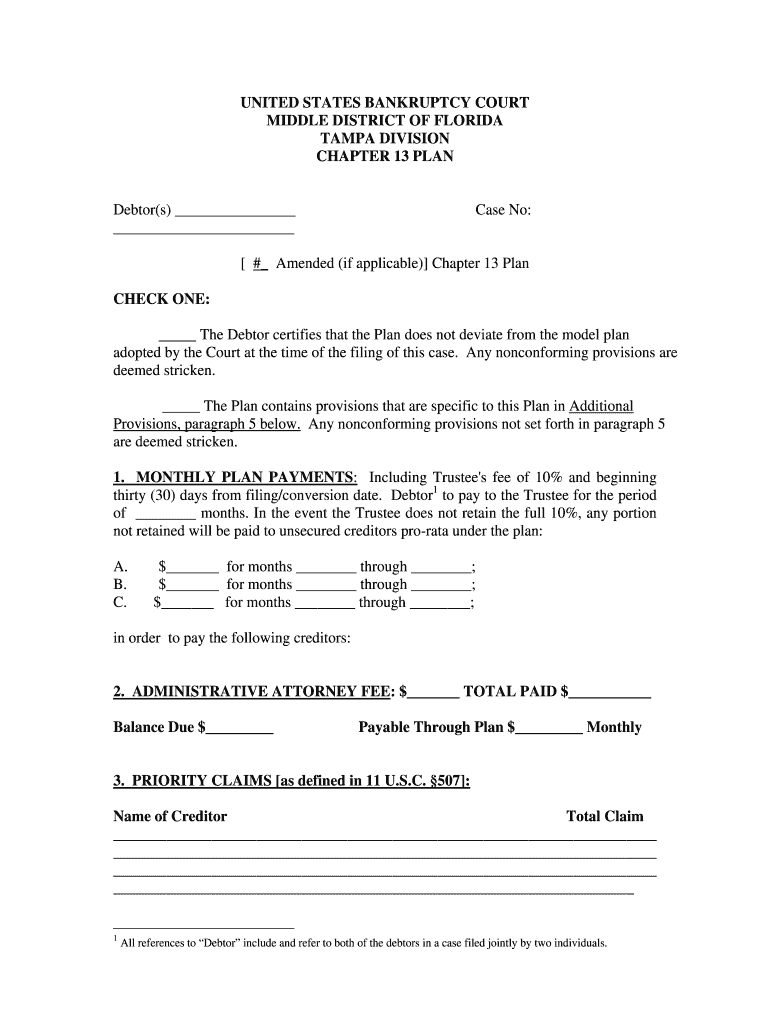

The Florida Chapter 13 Plan is a legal document that outlines the terms and conditions for repaying your debts under Chapter 13 bankruptcy. Filling out the form requires careful attention to detail. Here are the general steps to fill out the Florida 13 Plan:

1. Obtain the form: You can usually find the Florida Chapter 13 Plan form on the website of the United States Bankruptcy Court Middle District of Florida. Download and print the form.

2. Personal Information: At the top of the form, provide the necessary personal information, including your name, address, phone number, and bankruptcy case number.

3. Attorney Information: If you have an attorney, provide their information in the designated section. If you are representing yourself, leave this section blank or indicate that you are pro se (i.e., acting as your own lawyer).

4. Plan Length: Indicate the proposed length of your Chapter 13 repayment plan. Typically, this can be three to five years.

5. Payment Terms: Enter the amount you can afford to pay each month towards your debts. This should be an amount you can realistically afford based on your income and expenses.

6. Priority Claims: List any priority claims in the appropriate section. These may include tax debts or unpaid child support.

7. Secured Claims: Provide details about any secured claims, such as mortgages or car loans. Indicate how you plan to handle these debts and whether you intend to surrender the collateral or keep it.

8. Unsecured Claims: List your unsecured debts, such as credit card balances or medical bills. Determine the percentage you plan to repay based on your disposable income.

9. Other Provisions: The plan may have additional provisions, such as surrendering certain property or reaffirming specific debts. Carefully review these sections and provide the required information.

10. Signature: Sign and date the form, indicating that the information provided is true and correct to the best of your knowledge.

11. Filing the Plan: Make multiple copies of the completed plan. File the original and additional copies with the bankruptcy court clerk. Remember to keep a copy for your records.

It is essential to consult with an attorney or a bankruptcy professional if you are not familiar with the complexities of bankruptcy law. They can provide you with guidance and ensure that you complete the Florida 13 Plan accurately.

Disclaimer: This information is provided as a general guide and is not a substitute for professional legal advice. It is recommended to consult with an attorney for specific guidance regarding your bankruptcy situation.

What is the purpose of florida 13 plan?

The purpose of the Florida 13 Plan is to establish fair and equal representation for minority voters in Florida during the redistricting process. It is a proposed redistricting plan that aims to create a 13th congressional district in Florida that provides a more equitable opportunity for minority communities to elect preferred candidates of their choice. This plan is designed to comply with the Voting Rights Act of 1965, which prohibits voting practices or procedures that discriminate on the basis of race, color, or membership in a language minority group.

What information must be reported on florida 13 plan?

The Florida 13 plan, also known as the Chapter 13 Bankruptcy Plan, must include various information related to the debtor's financial situation and proposed repayment plan. The following information must typically be reported on a Florida 13 plan:

1. Debtor Information: The plan should include the debtor's full name, address, Social Security number, and contact details.

2. Creditor Information: A list of all creditors, including their names, addresses, account numbers, and the amount owed to each creditor.

3. Income and Expenses: Detailed information about the debtor's monthly income from all sources, including employment, business, rental properties, pensions, and government assistance. Additionally, all monthly expenses, such as rent/mortgage, utilities, transportation, food, insurance, and childcare, should be listed.

4. Debts and Liabilities: Comprehensive listing of all outstanding debts, including credit card debts, medical bills, personal loans, tax debts, and any other obligations.

5. Property and Assets: Inventory of all the debtor's property and assets, including real estate, vehicles, bank accounts, investments, retirement funds, and personal belongings.

6. Current and Proposed Payments: The plan should outline the debtor's current monthly payments to secured creditors (e.g., mortgage or car loan payments) and specify any proposed changes or adjustments to these payments.

7. Priority and Non-priority Debt: Different types of debt have varying levels of priority. The plan must clearly indicate how priority debts (such as tax debts or child/spousal support) will be repaid during the bankruptcy process.

8. Proposed Repayment Plan: The debtor must present a detailed repayment plan, outlining how they intend to distribute their disposable income among the different creditors over a specific period (usually three to five years). The plan should explain the order and priority of creditor payments.

It's important to note that specific requirements and documentation may vary based on individual circumstances, local bankruptcy court rules, and the advice of an attorney. Therefore, consulting with a bankruptcy attorney is highly recommended for accurate and up-to-date information regarding the Florida 13 plan.

What is the penalty for the late filing of florida 13 plan?

According to the United States Bankruptcy Code, there is no specific penalty outlined for the late filing of a Chapter 13 plan in Florida. However, the consequences of filing late can include the dismissal of the bankruptcy case or the imposition of additional fees by the court.

It is important to note that bankruptcy cases and their specific requirements can vary, so it is recommended to consult with a bankruptcy attorney in Florida for personalized advice pertaining to your situation.

Can I create an eSignature for the florida 13 plan in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your florida 13 plan sample form right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

Can I edit florida chapter 13 plan on an iOS device?

Create, modify, and share how to fill out chapter 13 forms and schedules and plan using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

How can I fill out show me a sample chapter 13 plan for middle district of florida orlando division on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your middle district of florida chapter 13 form plan. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.